European context

In the first quarter of 2024, the European office market showed similar dynamics to the previous year as a whole, with a slight drop of 5% in absorption compared to the previous year. However, there were divergent trends in the main European markets, as indicated by the increase in absorption levels in Paris, Barcelona and Munich, as opposed to the continuing falls in demand in Madrid, London and Milan.

In this international context, Lisbon is among the markets with the most significant recoveries in demand, and continues to have the lowest rents in Europe, which has contributed to the attractiveness of the Portuguese market and the consequent attraction of international companies.

Absorption in Lisbon

After a year in which office take-up fell sharply, the first months of 2024 saw a remarkable recovery in demand in this sector. In fact, the office market posted its second-best result in the first five months of the year in the last decade, with take-up of 118,831 sq.m, surpassing the previous year’s total of 115,000 sq.m.

Source: LPI/Wor

This volume of take-up reflects, on the one hand, the 20% increase in demand for 72 deals compared to the same period last year, and also reflects a significant increase in the average deal to 1,650 sq.m, roughly triple that of the same period the previous year.

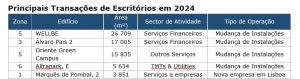

In this context, the substantial increase in average business was largely the result of the occupation of two buildings in their entirety, with over 15,000 sq.m each, by companies in the Financial Services sector. More specifically, the sale of the WELLBE building, with around 26,700 sq.m, to Caixa Geral de Depósitos, and the occupation of 17,000 sq.m of the Álvaro Pais 2 building. Also among the most significant transactions to date, we would highlight the placement of the first tenant in the Oriente Green Campus, currently still under construction, in an operation which includes the occupation of 15,000 sq.m by the European University.

Source: LPI/Wor

Main Office Transactions in 2024

Source: LPI/Worx

The two operations mentioned above contributed greatly to the absorption levels of zone 5 (Parque das Nações) and zone 3 (Emerging Zones) which, although they didn’t record the highest number of deals, garnered around 40% and 20%, respectively, of the total area placed, which corresponds to approximately 48,200 sq.m and 28,000 sq.m.

Zone 6 (Western Corridor), meanwhile, stood out as the most sought-after, attracting the largest number of transactions so far. However, the twenty deals amounted to only 15,900 sq.m, given the small size of most of the transactions, most of which were under 1,000 sq.m.

¹January to May

Source: LPI/Worx

Nevertheless, it’s important to note the growing appetite for central locations, with zone 1 (Prime CBD) seeing the biggest increase in the number of transactions, which tripled compared to the same period last year. Prime CBD recorded 15 transactions totaling 12,600 sq.m of occupied area, or around 10% of the total area absorbed.

Zone 2 (CBD), on the other hand, recorded the same number of transactions as in the same period last year, although the area absorbed doubled to 9,680 sq.m.

In fact, zones 1 and 2 together account for 40% of office market transactions in Greater Lisbon, which confirms the continued attractiveness of central locations, with access and proximity to transport services being prioritized by tenants, along with the modernity of the spaces, and also sustainability criteria.

Finally, zone 4 (Historic Center) is the only zone to show a lower volume of absorption than in the same period last year, with only three transactions, resulting in around 3,800 m² occupied. However, it should be stressed that this dynamic is the result of the limited area available in this zone.

In terms of the type of transactions, relocations were the main driver of demand, accounting for more than half of this year’s deals and more than 80% of the area absorbed, following the trend of previous years.

Source: LPI/Worx

In this context, the entry of 14 new companies in the Lisbon region in the period under review underlines the recovery trend in the office market and reassures the attractiveness of the Portuguese market.

While the previous year saw recruitment difficulties for international companies hindering their entry into Lisbon, current indicators suggest that these challenges may be being overcome. The rise in the unemployment rate in recent quarters may also have contributed to this.

In fact, this is the highest number of new companies in the Lisbon region since 2018 for the same period in previous years.

These new companies in the Lisbon region come mainly from the TMT and Utilities sector and the Construction and Real Estate sector, and represented the occupation of 10,993 m².

Demand profile

With regard to the demand profile, the TMT and Utilities sector continues to lead demand in terms of the number of deals, with 20 operations resulting in around 20,100 m² occupied.

In fact, in terms of area allocation, the Financial Services sector had the largest market share with 40% of the area absorbed to date, totaling 48,000 m².

Finally, we would like to highlight Other Services, which saw significant growth compared to the previous year, largely driven by demand from Higher Education, which took up more than 17,600 sq.m.

Office supply

With regard to office supply, although no completions have been recorded so far, it is anticipated that nine buildings will be delivered this year, representing an addition of around 142,000 sq.m to Lisbon’s office stock.

Zones 5 and 6 should see the biggest increases in supply, specifically around 59,500 sq.m and 52,200 sq.m more, respectively. Among the main completions expected this year are the Oriente Green Campus (zone 5) with 38,000 sq.m, the Oeiras City Council headquarters (zone 6) with approximately 30,500 sq.m and the Echo building of the EXEO Office Campus (zone 5) with around 21,500 sq.m.

In short, the office market should see a substantial increase in new supply this year, with an increase in area three times greater than the previous year, which was no more than 42,400 sq.m.

Availability

In the first quarter of 2024, there was a slight increase in the availability rate from 9.3% to 10.0%, mainly due to a redefinition of office zones and the consequent inclusion of buildings that were previously included in zone 7 (Other Zones). In this sense, it is important to note that the increase in the vacancy rate at the start of this year does not reflect an increased vacancy rate, but rather an increase in stock due to the redesign of office areas.

Still referring to the evolution of availability, the nine conclusions planned for this year and the respective area in the pipeline should not represent a substantial change in the availability rate, given that more than 97,000 sq.m are previously leased, around 70% of this area.

Market rents

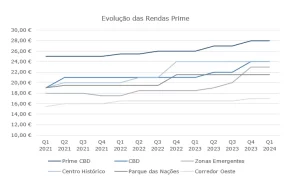

As far as market rents are concerned, there has been a relative stabilization of prime rents in all zones at the start of the year, after a progressive rise over the last year, triggered by the closure of deals in new buildings, along with the low availability rate in the more central zones, namely Prime CBD and CBD. In the Emerging Zones (zone 3), on the other hand, there was an upward effect on prime rents due to the closure of several deals in the Ramalho Ortigão 51 building, which has particular characteristics and is not representative of the stock available in the area.

As a result, the prime rent in zone 1 (Prime CBD) currently stands at 28€/sq.m/month, 8% higher than in the same period last year. Similarly, zone 2 (CBD) has a prime rent of 24€/sq.m/month, 14% higher than the same period last year.

Also in this area, zone 3 (Emerging Zones) saw the biggest growth in the last year, of around 24%, to 23€/sq.m/month.

Source: Worx

Despite the current stabilization, a further rise in rents in zones 2 and 4 can be expected by the end of the year, triggered by deals in buildings still under construction, scheduled for completion this year, and which still have space available, specifically República 5 (zone 2) and Cais 5 (zone 4).

Outlook

Generally speaking, given the dynamism of office occupancy activity in the first few months of the year, we could see an annual result above the average of the last 10 years, i.e. above 160,000 sq.m placed in Greater Lisbon. As a result, 2024 could see one of the best occupancy results of the last decade, in line with the figures recorded in 2018 and 2019.

Opinion article by Catarina Branco, Research Analyst at Worx, published in the June edition of Confidencial Imobiliário magazine.