Macroeconomic Context

According to the data and projections released by the Bank of Portugal, the Portuguese economy grew by 2.3% in 2023, showing a slowdown in economic growth compared to the previous year (6.8%).

In fact, despite the good performance at the start of the year, the second and third quarters brought with them some stagnation in the economic climate, due essentially to the slowdown in private consumption and investment, as well as the slowdown in exports.

As a result of successive rises in benchmark interest rates, the inflation rate entered a downward trend, from 8.1% in 2022 to an average of 4.3% in 2023, a trend that should continue this year, anchored in monetary policy. Even so, the European Central Bank’s 2% target is not expected to be reached until 2025.

The robust dynamics of the services sector largely contributed to the resilience of the labor market last year, even though the second half of the year saw a slowdown, with the unemployment rate expected to rise to 7.1% this year.

This more moderate economic growth reflected the weakness of external demand, the effects of high inflation and the tightening of monetary policy, the latter having a significant impact on the financing conditions of economic agents. Given the less favorable international environment, domestic demand played a key role in economic activity in 2023.

This trend is expected to continue this year, with even more moderate dynamics and a slowdown in economic growth to 1.2% of GDP. However, the first signs of recovery are expected to begin in 2024, resulting in a reversal of the slowdown trend in 2025.

According to the same source, despite the expected slowdown in economic growth, Portugal will still grow above the eurozone (projected average growth of 0.8%), thanks to the acceleration in exports and investment, the impact of lower inflation on household disposable income and the boost from European funds.

Nevertheless, it is important to note the high level of uncertainty in the international panorama inherent in the current geopolitical tensions, uncertainty which, for the time being, also characterizes the national panorama given the context of early elections.

Investment in Europe

With the financial market deeply marked by successive interest rate rises in response to the context of high inflation, in 2023 the volume of investment in commercial real estate in Europe reached around 133 billion euros, showing a drop of around 50% across all sectors.

The office sector and the Industrial and Logistics sector were among the sectors most penalized by the financial climate, with falls of around 60% and 50% respectively. In 2023, the office sector even recorded its lowest investment figure in the last decade, while the Industrial and Logistics sector reached its lowest figure since 2016.

With more encouraging results, the hotel sector proved to be the most resilient in the last year, based largely on the full recovery of demand levels from the pre-pandemic period. Investment in the sector amounted to 11 billion euros last year, reflecting a more moderate drop of around 20% in comparative terms. It is important to note, however, that the hotel sector is still not at the top of investors’ preferences, accounting for less than 10% of the capital invested.

The retail sector accumulated a total of 26 billion in investment, also marking a significant drop of 40%.

Despite this scenario, offices continue to lead investor preferences, accounting for around a third of the total investment volume, followed by the industrial and logistics sector.

Investment in Portugal

Following the trend of the main European markets, albeit more moderately, Portugal attracted around €1.6 billion in investment in commercial real estate in 2023, which represents a drop of 45% on the previous year. The global context of uncertainty resulted in a drop in foreign investment, which represented around 70% of the volume of investment in 2022, while last year it accounted for less than half, specifically 42%.

The majority of foreign capital invested in Portugal came from the United States of America, accounting for 16% of the total, followed by Switzerland with 6% and France and the United Kingdom with 4% each. In this respect, the North American market’s appetite for allocating capital to retail and hotel assets is noteworthy.

With regard to the type of players, there was a decrease in the participation of property companies and REITs compared to the previous year, while there was a greater representation of funds, which accumulated 73% of the capital invested in 2023.

The hotel sector accounted for the lion’s share of investment (40%), with a total of 640 million euros, and saw the biggest transaction of the year with the sale of the Dom Pedro hotel portfolio to Arrow Global for 250 million euros. The sector’s excellent operating performance, which has surpassed all previous records, has greatly boosted the attractiveness of hotel assets in Portugal.

Retail was also one of the most resilient sectors, and was even the only sector to record a higher volume of investment than the previous year. It accounted for around 559 million euros in 2023, driven by the sale of a supermarket portfolio for 150 million euros to LCN Capital Partners and a retail park portfolio acquired by First Retail Partners for 100 million euros. In terms of asset type, supermarkets attracted more than 40% of the volume invested in the sector, followed by shopping centers (30%) and finally retail parks (18%).

Offices saw one of the sharpest falls in the volume of investment, in the order of 69%, with a total of 177 million euros, the lowest figure since 2013. Among the main deals of the year were the Castilho 20 transaction between Deka Immobilien funds, and the acquisition of Pier III – Boqueirão do Duro by BNP Paribas REIM, both of which were transacted for between 30 and 35 million euros.

Alternative assets accounted for 11% of investment, with the sale of the Altice Arena to Live Nation being the largest transaction of the year, although student residences accounted for more than half of investment in this segment.

Finally, Industrial & Logistics captured just 3% of investment, with the largest transaction of the year being the purchase of two factories by Square Asset Management.

In short, in the domestic market, hospitality continued to be the most attractive sector for investment, although there was a greater appetite for the retail sector in 2023. This attractiveness was driven in both cases by the operational performance of the assets in these segments.

Prime Yields

Thanks to the normalization of the ECB’s monetary policy to control inflation, 10-year government bonds (OTs) reached their peak yield in the last quarter of the year, with 3.59% in October 2023. This figure was the highest since the second quarter of 2017.

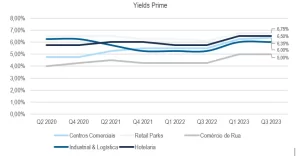

The context of falling investment across the different sectors and more restrictive conditions for access to financing led to a general decompression of prime yields over the last year, with increases of between 50 and 75 b.p. over the last year. The Office and Industrial and Logistics sectors saw the most significant annual increases, of 125 b.p. and 75 b.p. respectively.

In the first half of this year, there could be a further decompression of yields, followed by a stabilization trend in the second half of the year, given the expectation of a reduction in interest rates in June and, consequently, a possible improvement in the conditions of access to financing. However, even if this drop is confirmed, it shouldn’t translate into a compression of yields in 2024, which will probably only happen in 2025.

Future prospects

In 2024, investment dynamics are expected to be very similar to those seen in 2023, as the global macro-financial context continues not to favor financing conditions. In addition, the market is experiencing a shortage of portfolios, portfolios that boosted investment volumes in the first half of last year.

The hotel and retail sectors should remain at the top of investors’ preferences. On the other hand, no substantial growth in investment is expected in the office sector, which also reflects the lack of product on the market.

From another point of view, the growing attractiveness of the Industrial and Logistics sector is likely to be largely confined to development activity, with the entry of new players into the market resulting in the development of new infrastructure for own occupation, so it is not expected that the sector will have a particularly strong impact on investment activity.

With regard to the alternative assets sector, 2024 should see the continued consolidation of student residences and, eventually, the expansion of the attractiveness of this type of asset to other locations outside the cities of Lisbon and Porto. Finally, there is expected to be growth in the senior housing and health segments, which are still emerging in the investment market, but with market fundamentals that should promote their attractiveness.

Opinion article by Catarina Branco, Research Analyst at Worx, published in the March edition of Confidencial Imobiliário magazine.