As we turn the corner from the first to the second half of 2023, it’s an opportune moment to reflect on some of the features of the commercial property market in Portugal in the first few months of the year, and particularly on some of its challenges.

In this first half of the year, along with growth above expectations and the maintenance of a relatively low unemployment rate, we have witnessed only a timid slowdown in inflation, which has fallen back to the “minimum” values recorded in December 2021, standing at 6.51% in May 2023.

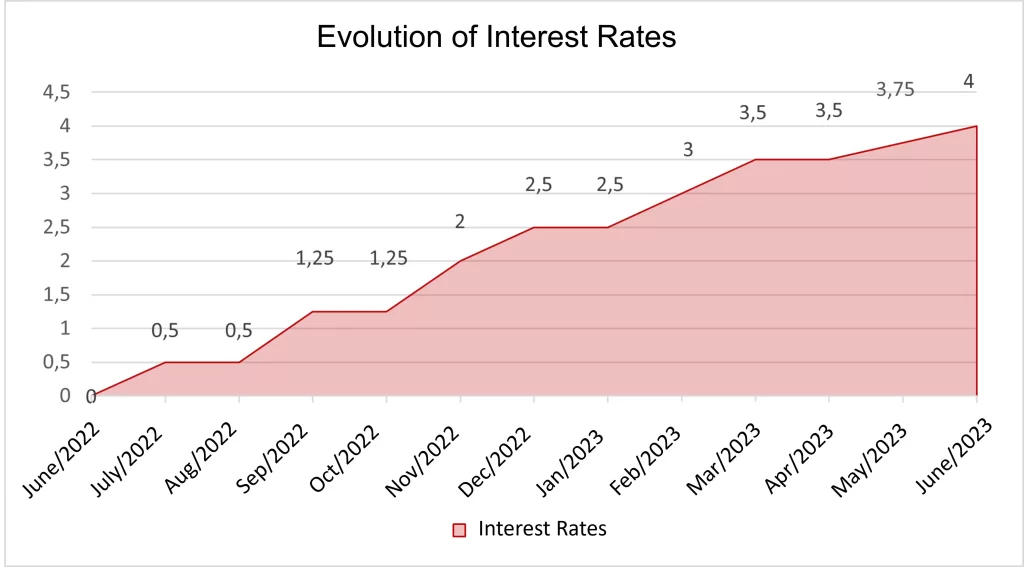

It’s not surprising that last week, during the European Central Bank forum in Sintra, President Christine Lagarde emphatically stated that high interest rates (compared to what we’ve been used to in recent years) are here to stay and should continue to rise, remaining at 4.00% until the next review (estimated at 25 basis points). This situation, which is not surprising, shows that the symmetrical commitment to an inflation rate of 2% in the medium term remains the ECB’s main objective.

As far as commercial property investment is concerned, and despite the obvious cautious stance of investors seen in recent months, the first half of 2023 showed a solid performance, with growth, still in preliminary figures, of around 686 million euros/13.4 % compared to the same period last year, growth that may, however, be partially justified by the portfolio transaction worth around 250 million euros, which included six D. Pedro hotels and five golf courses.

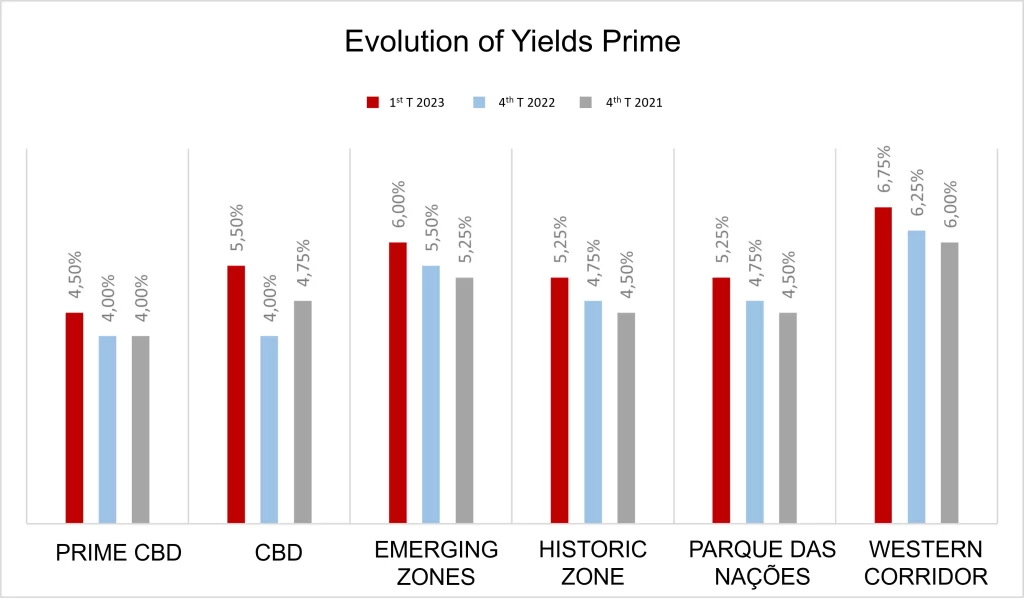

Given the data, the fundamentals of the first half of the year are likely to continue until the end of the year, including high interest rates, which in turn will push yields higher than those seen in much of 2022, as can be seen in the table of yields prime.

The adjustment observed in profitability rates has been reflected in investment intentions, increasing the risk of a mismatch between the price expectations of buyers and sellers, which should affect the volume of transactions and negotiations throughout the second half of the year.

In this context, the case of the Western Corridor becomes a real challenge.

According to the latest available data, the vacancy rate in Greater Lisbon in the first quarter of 2023 stood at 406,900 sq.m, reflecting a rate of 9.2% (214,800 sq.m in the municipality of Lisbon – 4.86%). While the Historic Zone has the lowest rate in the market, at around 2.2%, followed by the CBD, with 4.0 per cent, the Western Corridor continues to be the area with the highest availability – 19.2% – which justifies reflecting on the apparent lack of interest and possible strategies to counteract this trend.

It’s not just now that the Western Corridor has the worst occupancy figures among Lisbon’s office areas. The challenge is structural and is years old. However, the rise in interest rates and the uncertainty in the market have put off less core investors and the outlook is not encouraging.

Surprisingly, or not, some office buildings in the area are being sold at prices per square metre lower than the (inflated) construction prices. Curiously, even though this is the case, the area continues not to arouse interest, not even among the most opportunistic investors.

Against this backdrop of vacancy, rising construction costs and investor demands for higher rates of return, it would be worth considering the opportunity to transform vacant assets in the Western Corridor into assets with greater and/or growing demand, many of them from alternative sectors, for instance the Healthcare and Living sector, where the shortage of supply continues to be evident.

Considering the growing demand for senior residences and healthcare facilities, and even for new forms of residential living such as co-living, converting vacant offices to alternative uses could prove to be an attractive solution. As well as mitigating the shortage of supply, it would in many cases make it possible to solve the problem of lack of occupancy, with more interesting returns than in traditional sectors, especially in brownfield projects. With assets being sold below their construction values, the cost of inflation is partially absorbed, helping to make the project viable and profitable.

At the same time, converting some of these assets to residential use, would not only make them more viable and profitable, but would also help to ease the pressure of demand on residential supply in the Lisbon metropolitan area.

The challenge for the municipalities in the area, especially Oeiras, has been launched. The “stick” that can proactively contribute to the dynamism and development of the Western Corridor is largely in their hands, starting with deliberating on potential changes of use in good time.

Utilisation for alternative uses in the face of inflation, high interest rates, rising yields and commercial disinterest: perhaps two birds with one stone.

Opinion article by Francisco Caldeira, Capital Markets, published in Magazine Imobiliário on 11th July 2023